Results from the second COVID-19 Farmer Survey

At the onset of the COVID-19 Pandemic, the Maine farm community was faced with endless uncertainty. Questions about the stability of markets for the season, how much product to plant and plan for, the safety of farm families and crews, and availability of supplies for packaging products and keeping workers safe were all unanswerable and causing significant stress. In an attempt to quantify the shifts that were happening among Maine Farms, to gather data on market trends from the farm gate perspective, and to gather data related to hurdles and stressors of Maine farms, a sub-committee of the Maine Farmer Resource Network formed to develop, distribute, and analyze the Maine Farmer COVID-19 Impacts Survey. Three rounds of this survey were released to gauge trends throughout the season, in early April, early May, and late September. Those results are summarized here.

April 21 to May 7, 2020: 79 Farms

The following is the data analysis from the second Covid-19 Maine Farmer Survey, hosted by the Beginning Farmer Resource Network of Maine, which received 79 responses from April 21 – May 7, 2020. Some of these farmers responded to the previous survey while some are first-time respondents. (See FIRST COVID-19 Maine Farmer Survey Data Analysis (179 responses) and THIRD COVID-19 Maine farmer Survey Data Analysis (69 responses) for additional data results.)

Data was analyzed for themes by Bo Dennis of the Maine Organic Farmers and Gardeners

Association, Jason Lilley of the University of Maine Cooperative Extension and Catherine Durkin of Maine Farmland Trust.

They can be contacted at:

Bdennis@mofga.org

jason.lilley@maine.edu

catherine@mainefarmlandtrust.org

Who Responded

| County | Number of Respondents per County | Number of Respondents per Region |

|---|---|---|

| Androscoggin | 4 | S. Maine 25 |

| Cumberland | 8 | |

| York | 5 | |

| Sagadahoc | 8 | |

| Franklin | 1 | W. Mountains 7 |

| Oxford | 5 | |

| Somerset | 1 | |

| Kennebec | 5 | Central / Mid-Coast 33 |

| Knox | 8 | |

| Lincoln | 7 | |

| Waldo | 13 | |

| Hancock | 6 | Down East 7 |

| Washington | 1 | |

| Aroostook | 0 | Central / Northern 7 |

| Penobscot | 3 | |

| Piscataquis | 4 | |

| TOTAL | 79 | |

Financial

- NOTE: During the timeframe of the survey, farmers were not eligible for EIDL and PPP had varying funding swings.

- Farmers are experiencing an increased cost of production due to purchasing new packaging materials, the switch to online sales platforms and associated fees, and necessary shifts in labor management. These are cutting into already thin profit margins. One respondent noted “No change (in sales), BUT the labor and packaging costs of distribution are much higher under new improvised retail markets that are keeping income stable.”

- The anticipated loss of tourism in heavy traffic summer months for farms as well as loss of agricultural fairs will have economic impacts.

- When asked “What is your leading concern for farming this season…?”, over half of the respondents said financial impact.

| Amount | # of Respondents | |

|---|---|---|

| Losses | $100-$1000 | 20 |

| $1000-$5000 | 8 | |

| > $5000 | 6 | |

| No Change | $0 | 17 |

| Increase | $100-$1000 | 11 |

| $1000-$5000 | 5 |

Financial support programs

- As of May 6, about 70% of respondents had not received any financial support from any program

- Of these respondents, more than 2/3 had not applied for any support for various reasons (confusing messaging, ineligible for programs, hadn’t looked into programs yet, aren’t in need of support)

- People are using PPP (Paycheck Protection Program) though some have encountered issues with lack of consistent funding for the program

- 24 respondents applied for PPP and 14 had received funding at the time of the survey

- People expressed issues and stress around accessing unemployment offices for sole proprietors.

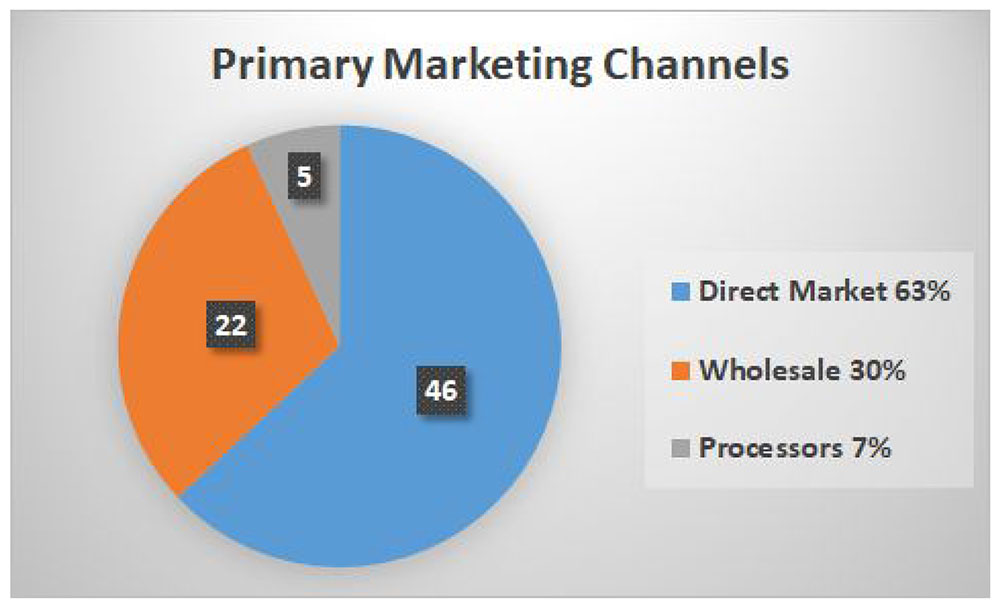

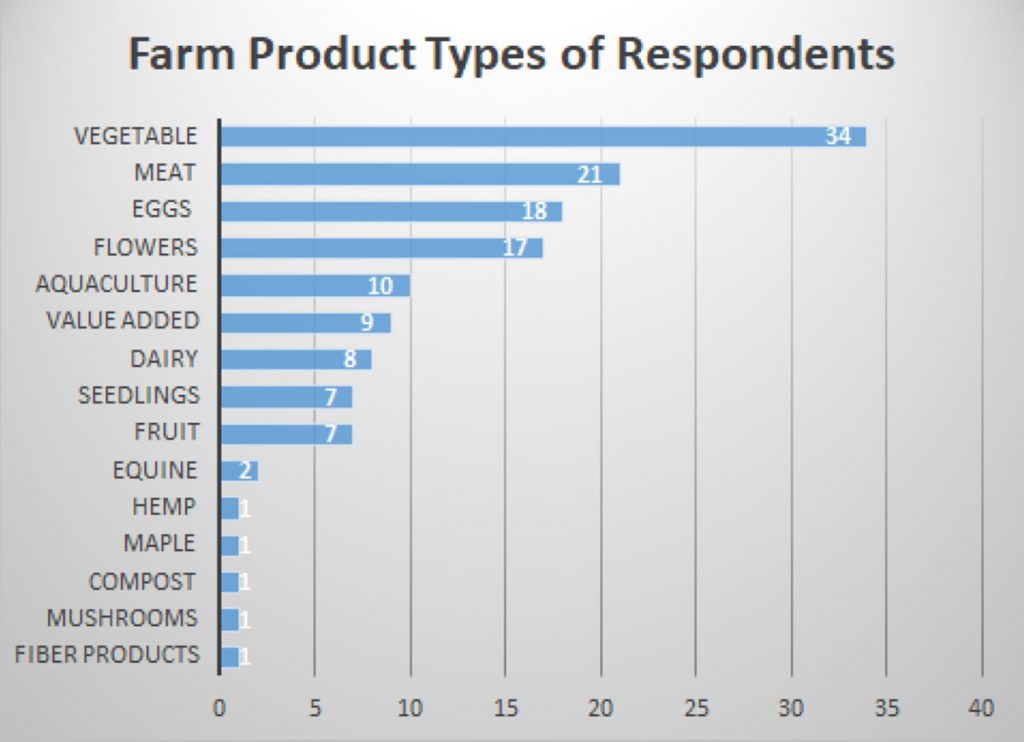

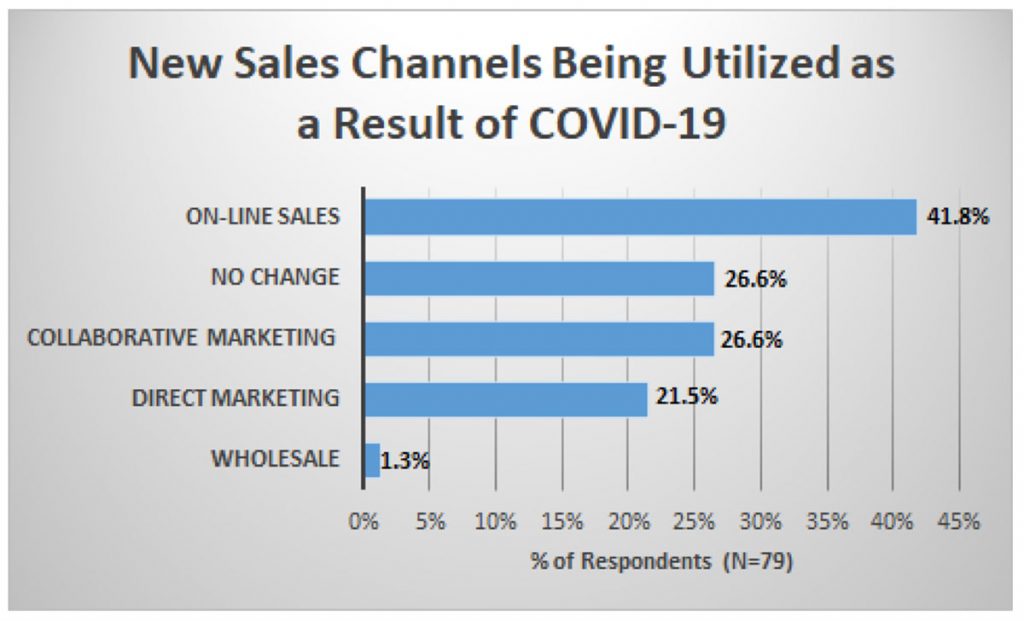

Market channel shifts

- “Balancing production and demand in market uncertainty” was a concern for 43% of respondents.

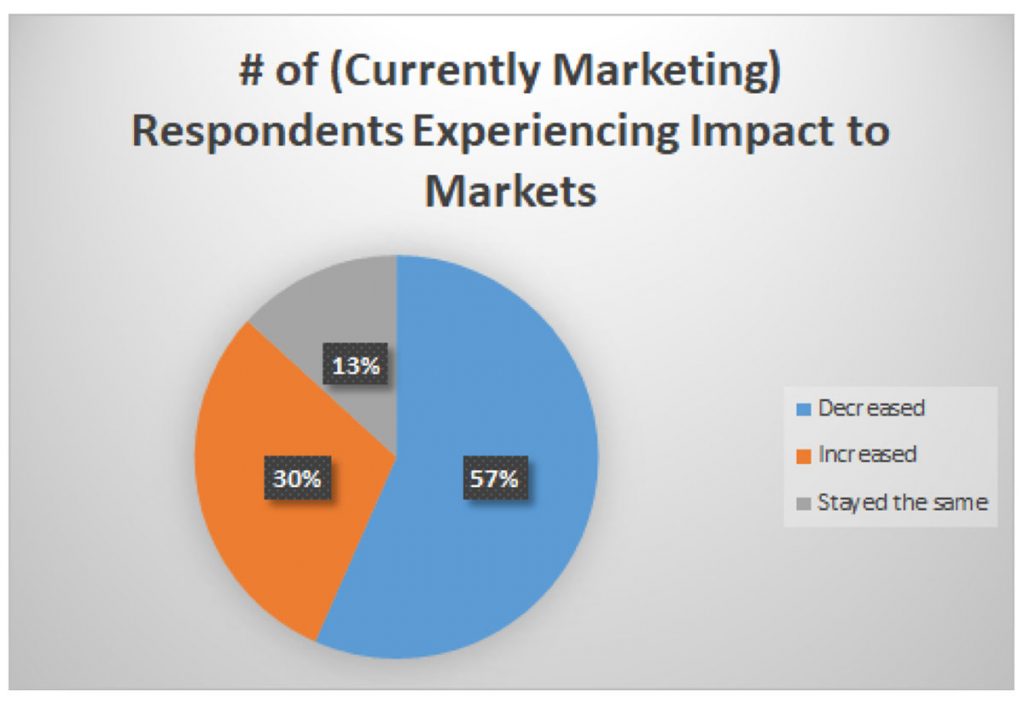

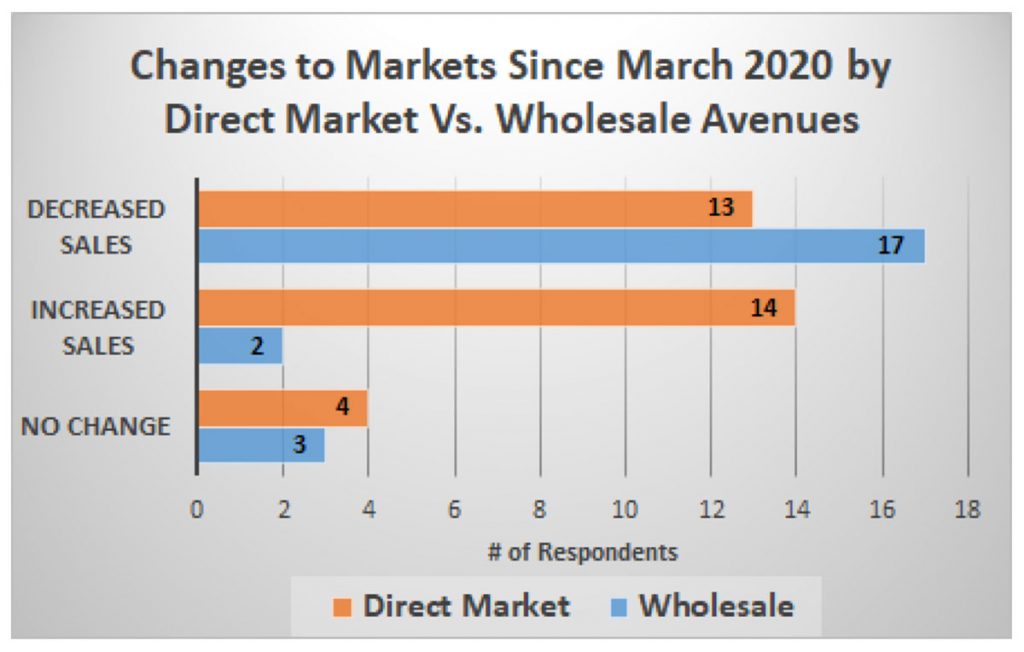

- Of those respondents who are currently selling products and tracking sales, 56.6% have experienced decreased sales, 30.2% have seen increased sales, and 13.2% have seen no change.

- Of those respondents who are currently marketing, the percentage of “primarily wholesale focused” farms who have lost sales (77.3%) is higher than the percentage who have lost sales from the “primarily direct to consumer” farms (41.9% of respondents).

- There is a strong trend towards online sales, curbside pick ups, low/no touch farm stands and CSA’s for customer, farm, and farm employee safety.

- Farmers are maintaining regular communication with customers through social media and email lists with updates around sales platforms and safety protocols.

- Some switches in production plans include increasing vegetable production over flower production, increasing seedling production for sales, or decreasing variety to simplify online ordering and pre-packing.

| Usual Marketing Channels (Pre-COVID-19) | Market Channels Lost Since March 2020 | |

|---|---|---|

| Direct Marketing | 60 | 15 |

| Wholesale | 46 | 25 |

| Processors | 7 | 0 |

| Institutions | 3 | 2 |

| Events | – | 9 |

NOTE: Several respondents noted marketing through multiple avenues. “Events” was not listed as a survey option for the question regarding usual marketing channels.

Labor management

- 53% of respondents with employees unhired workers, reduced employee hours, fired employees, delayed start date or are hiring fewer employees this year.

- Farmers are noting an increase in labor time to practice safe production and distribution (for example social distancing on farm as well as time in packing).

- There is a fear of hired labor getting sick and lack of contingency planning.

- There is an added farm stress with managing PPE, safe distancing, and hand washing around the farm.

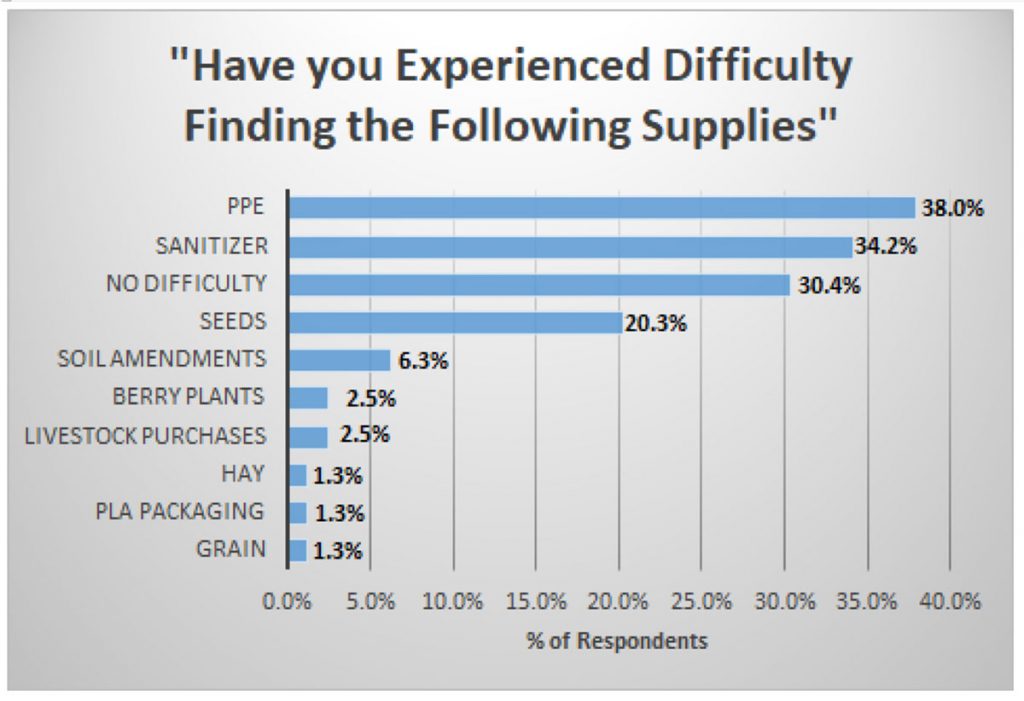

General needs

- Farmers are struggling to find personal protective equipment as well as hand sanitizer

- Financial support

- About ⅔ of respondents who said they needed financial support in order to navigate Covid-19, had not received any support at the time of the survey

- 30% of respondents are looking for marketing assistance support

- 38% of respondents noted difficulty finding personal protective equipment. Another 34% have had trouble finding sanitizer, while 20% of respondents have had difficulty finding seeds and seedlings.