Results from the first COVID-19 Farmer Survey

At the onset of the COVID-19 Pandemic, the Maine farm community was faced with endless uncertainty. Questions about the stability of markets for the season, how much product to plant and plan for, the safety of farm families and crews, and availability of supplies for packaging products and keeping workers safe were all unanswerable and causing significant stress. In an attempt to quantify the shifts that were happening among Maine Farms, to gather data on market trends from the farm gate perspective, and to gather data related to hurdles and stressors of Maine farms, a sub-committee of the Maine Farmer Resource Network formed to develop, distribute, and analyze the Maine Farmer COVID-19 Impacts Survey. Three rounds of this survey were released to gauge trends throughout the season, in early April, early May, and late September. Those results are summarized here.

March 18-27, 2020: 179 Farms

The following is the data analysis from the first Covid-19 Maine Farmer Survey, hosted by the Beginning Farmer Resource Network of Maine, which received 179 responses from 3/18-3/27. (See SECOND COVID-19 Maine Farmer Survey Data Analysis (79 responses) and THIRD COVID-19 Maine farmer Survey Data Analysis (69 responses) for additional data results.)

Data was analyzed for themes by Bo Dennis and Ryan Dennett of the Maine Organic Farmers and Gardeners Association, Jason Lilley of the University of Maine Cooperative Extension, and Catherine Durkin of Maine Farmland Trust.

Who Responded

| County | Number of Responses per County | Number of responses by Region |

|---|---|---|

| York | 14 | S. Maine |

| Cumberland | 19 | 60 |

| Androscoggin | 10 | |

| Sagadahoc | 17 | |

| Oxford | 12 | W. Mountains |

| Franklin | 5 | 24 |

| Somerset | 7 | |

| Kennebec | 13 | Central / Mid-Coast |

| Knox | 9 | 51 |

| Lincoln | 13 | |

| Waldo | 16 | |

| Hancock | 12 | Down East |

| Washington | 5 | 17 |

| Aroostook | 12 | Northern / Central |

| Penobscot | 7 | 23 |

| Piscataquis | 4 | |

| TOTAL | 175 | |

Financial

- Strong need for financial support to help with cash flow

- Both anticipated cash flow challenges and current cash flow issues

- Desire for reimbursement for sales loss and donations

- Loan repayment deferment and 0% loans

- Some want grants, not loans, given the fear of unpredictable markets and unstable economy

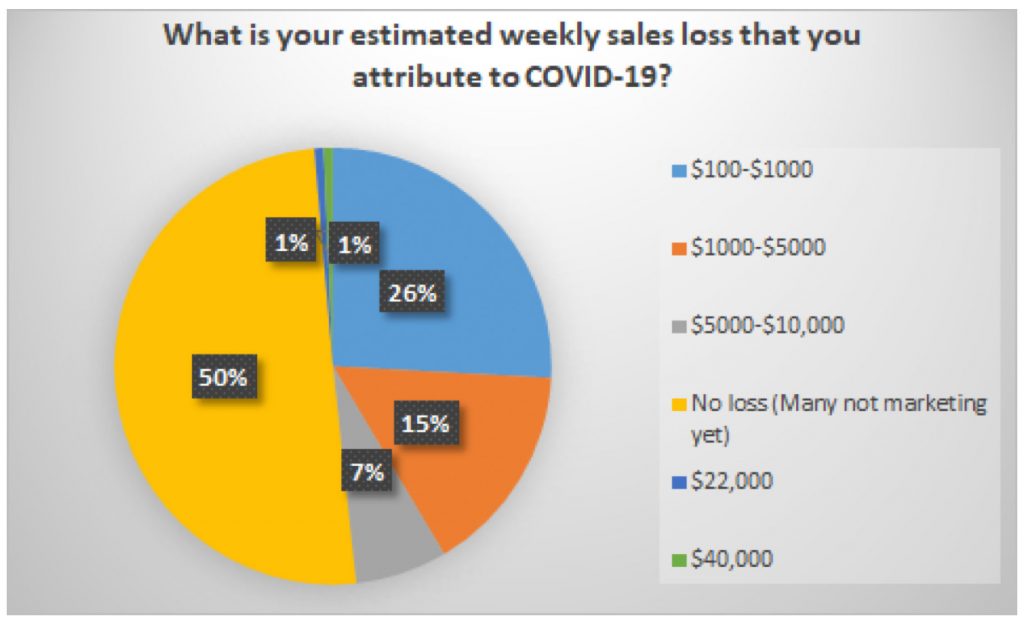

Of the entries who commented on their change in sales since the outbreak started, 57% have noted decreases, 18% have noted increases, and 25% have not had changes to sales. NOTE: It has only been 2 weeks. Also, many respondents do not have marketable products at this point in the season. Those farms were left out of the above analysis.

Market channels and customer demand

Direct vs. Wholesale trends, product

- Beginnings and overall desire for farmer based aggregation with some desire for help organizing these aggregation efforts

- There is a shift in marketing channels to include more CSA, food delivery, no touch farm stands

- Questions around how the tourist economy will be impacted and how this will affect sales

- Anticipating weddings, events, on-farm workshops, on-farm dinners etc. being postponed or cancelled

Marketing

- Farmers want information on how to market if markets close and advertising in the time of COVID-19 (How to get produce to customers with little interaction?)

- There is a need to increase marketing to reach new customers if consumers aren’t coming to market and need for more “how to market” support

- Ecommerce and increasing digital based marketing, online stores. Need for training here

- Those who noted an increase in sales are primarily meat, egg, and dairy producers.

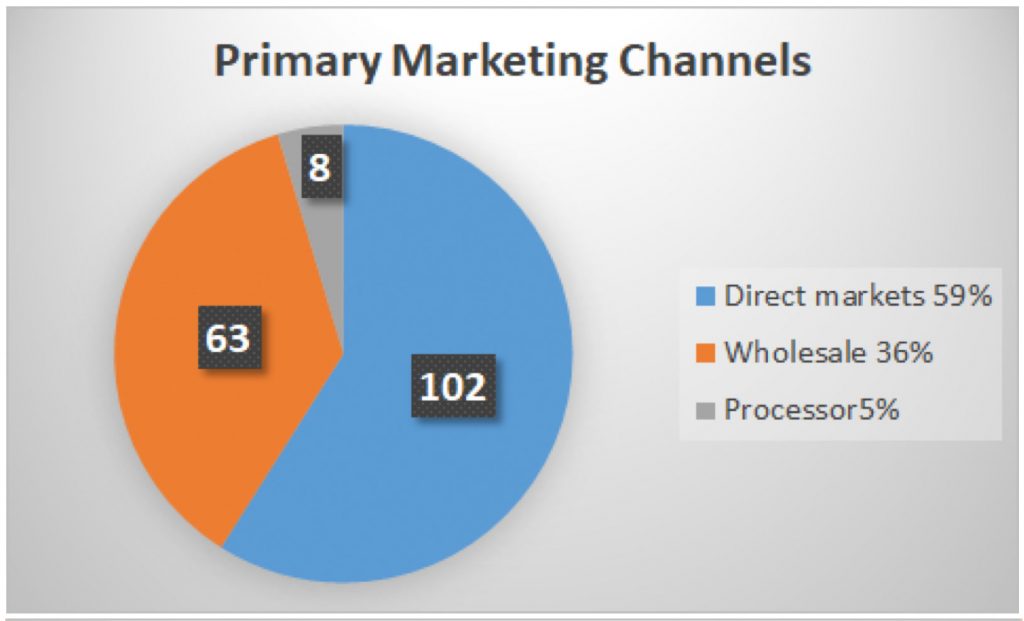

- Traditiditionally, 59% of respondents direct market their products, 36% primarily sell wholesale, and 5% are processors.

Labor management

Cash flow, workplace safety, unemployment

- There is a need for labor but a fear of not being able to pay them as well as health concerns (worry about employees staying healthy and how this will affect the workforce)

- Support needed for paying for employees

- Letting people go, un-hiring, reducing hours

- Starting employees later to help with cash flow, matching production and workforce

- Increase labor/time to design and implement new systems and find new sales channels

Mental health

- Mental health support needed

- Strong fears of business closure and financial stresses across majority of farm responses

- A lot, a lot of uncertainty

General needs

- Farmers request updates on health practices and how to safely conduct sales

- It is still very uncertain how this will affect the summer sales, supply chain and labor. Many suggest to resend out survey in a few weeks and a few months

- Challenges finding sanitizers for the farm (mostly hand sanitizer to have at farmers’ markets etc.)

Examples of changes farmers have made

- Over fear of supply chain issues, farmers are prebuying supplies

- Farmers are increasing hand washing and sanitizing protocols on farms, social distancing employees at work

- Not a positive one but multiple farms mentioned putting larger capital investments/equipment upgrades on hold